Happy New Year, you guys! I have been getting a lot of requests for a blog post about using the Budget Notebook and also for tips on budgeting in general. I think it’s the perfect time to share some of my habits for budgeting considering we just started a brand NEW year!

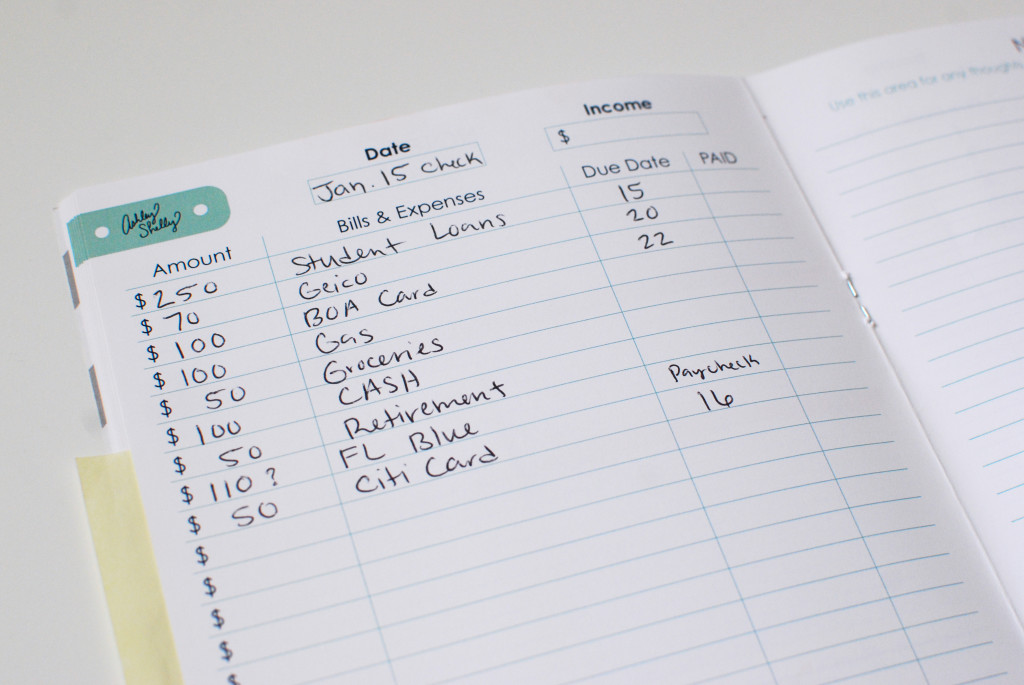

For me, the most important aspect of budgeting is to WRITE. IT. DOWN. Everything. All of it. There is something about writing out the numbers every paycheck for me that makes it realistic and do-able. If I don’t write everything out, I will most likely forget a bill, or a gift I want to buy for someone, or that I want to save money for a holiday coming up. The image below is an example of a clean slate paycheck (2 week period for me personally, but you can do this weekly or monthly as well). Before I get my check deposited into my account, I already know when all of my bills are due, and I write each one down, including bills with due dates and expenses like gas and groceries.

For me, the most important aspect of budgeting is to WRITE. IT. DOWN. Everything. All of it. There is something about writing out the numbers every paycheck for me that makes it realistic and do-able. If I don’t write everything out, I will most likely forget a bill, or a gift I want to buy for someone, or that I want to save money for a holiday coming up. The image below is an example of a clean slate paycheck (2 week period for me personally, but you can do this weekly or monthly as well). Before I get my check deposited into my account, I already know when all of my bills are due, and I write each one down, including bills with due dates and expenses like gas and groceries.

I allow myself a realistic budget (again, this is just for me personally) for items like gas, groceries, and spending cash. I know how much gas I typically use every 2 weeks and I try to stay within that limit unless an emergency comes up. If I am going out of town on a trip and driving there, I save money separately for that gas and include it in trip expenses. That’s one thing I had to realize myself, that money isn’t a magical thing that will just go where it needs to and everything will be fine. We have to do all of this planning ON PURPOSE.

A lot of these decisions need to be made realistically and not in a “hoping for the best” mindset. That way, you can stay on budget and feel accomplished at the end of each pay period! Once I write it all out and look over everything for the 2 weeks, I almost have it memorized in my mind at this point and always check back in with my Budget Notebook to check things off and make sure I am within budget.

Of course, life is real and things always happen and change. So one of the amazing freedoms of budgeting in such a detailed way is when things need to be adjusted or last minute emergencies come up, you will have ROOM for that! We all need to be saving money. I was so guilty of not doing this right out of college. It took me a few years to really make this a priority. It’s so easy to buy new clothes that we think we can’t live without or spend so much eating out for dinner instead of cooking at home. I was there and made a lot of mistakes financially before I really got it 🙂

Of course, life is real and things always happen and change. So one of the amazing freedoms of budgeting in such a detailed way is when things need to be adjusted or last minute emergencies come up, you will have ROOM for that! We all need to be saving money. I was so guilty of not doing this right out of college. It took me a few years to really make this a priority. It’s so easy to buy new clothes that we think we can’t live without or spend so much eating out for dinner instead of cooking at home. I was there and made a lot of mistakes financially before I really got it 🙂

To save money, you HAVE to pay yourself first. Even if you only can afford to save $10 a paycheck in a separate account, DO THAT. Don’t think it has to be a lot. My New Year’s resolution for 2015 is to start putting money away for retirement. I am 29 and I need to do it. It needs to start and this year is the year for me! I am going to put away $50 a paycheck to a retirement savings account. It will go automatically, and that money will never have the option of being spent for something else. So whether you want to save for a fun vacation, retirement, or a general savings account for security, start now. As small or big as you can, what matters is starting.

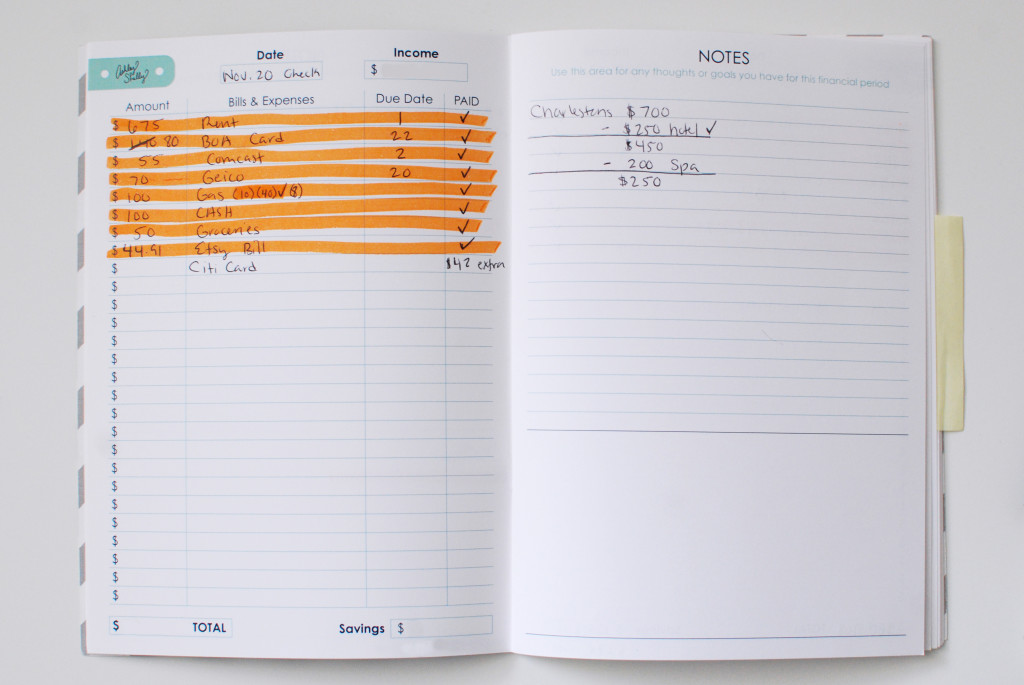

The image below is an example of a pay period that is completed. I use highlighters on my Budget Notebook to cross things off when they are paid. For some reason a check mark is just not enough for me. I am a visual person, so I want to KNOW that bill is PAID! haha. Highlighters work for me and you may like this idea too. I used the “Notes” section to budget out a fun weekend trip we took to Charleston, SC last year and that space can be used for anything. Options, I like options!

I hope a little peek into my own Budget Notebook helps y’all use yours better and enjoy it even more. I seriously love doing this every paycheck now. It’s actually FUN to me because I know I never have to worry and be anxious about where my money is going or if I can afford everything I have on my plate.

I hope a little peek into my own Budget Notebook helps y’all use yours better and enjoy it even more. I seriously love doing this every paycheck now. It’s actually FUN to me because I know I never have to worry and be anxious about where my money is going or if I can afford everything I have on my plate.

So here are some key tips I would recommend in general for budgeting in 2015:

-Write everything down

-Be realistic about your money (don’t budget more for something you don’t actually need)

-Put away at least a portion of your money into savings

-Cross things off when they are paid and check back in with your Budget Notebook often (I do daily)

-Plan for the fun things and don’t just hope they will be affordable

-Knowledge is power, so look at everything you have on your plate and take some time to plan it all out

Feel free to post questions in the comments on this post or follow along on Instagram @ashleyshelly and I will be happy to help any way I can. Happy 2015 y’all. Thank you for supporting my brand and being so sweet!